One Of The Best Tips About How To Reduce Debt Payments

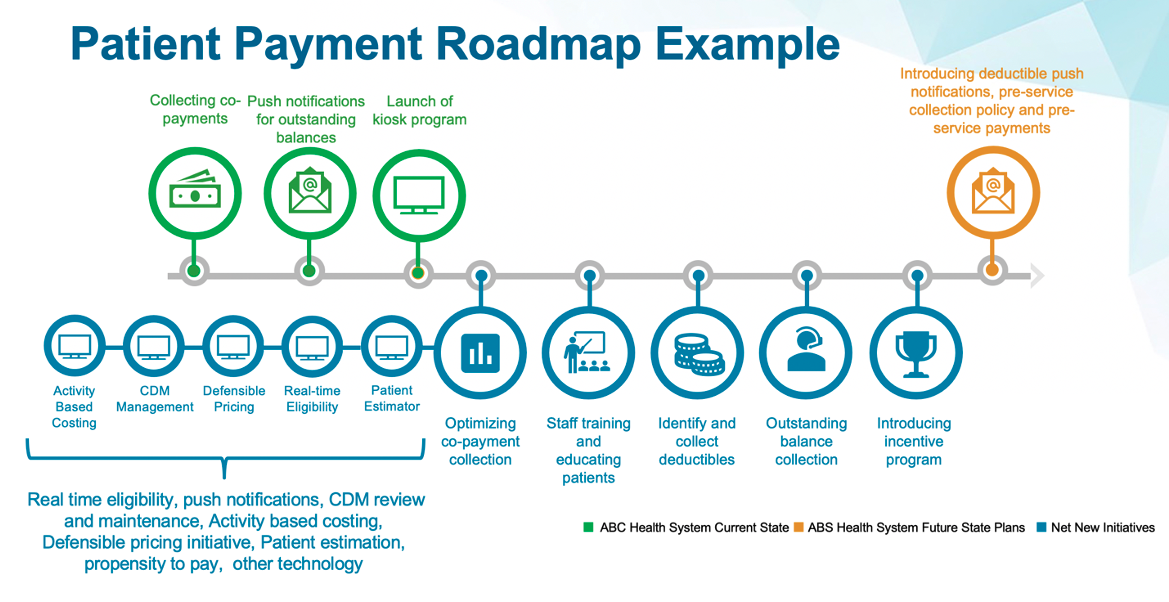

Your first step is to figure out what you can pay.

How to reduce debt payments. If there's money left over after your monthly bills are paid, use it to pay down your current debt. You would get lower payment by lengthening the time (up to 30 years) you’ll have to pay off the loan. Recast or refinance your mortgage.

Enroll in autopay this is likely. Look at your income and expenses. The downside is you’ll make more payments and pay more interest over the.

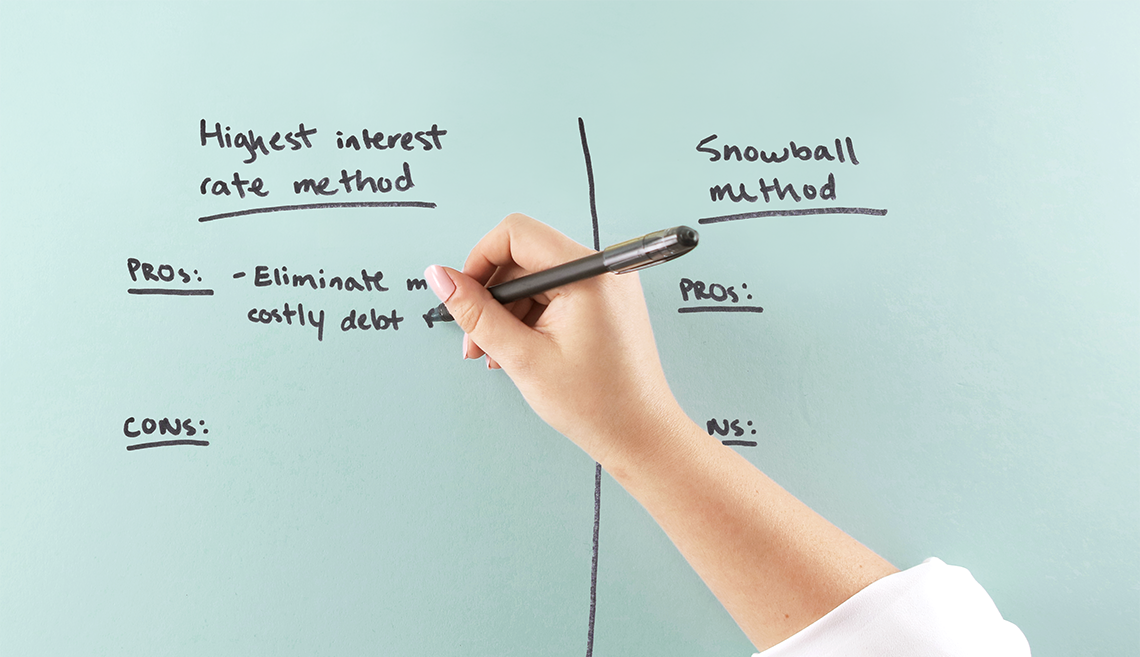

Interest rates on loans can be quite expensive, so the lower your total. If it’s not affordable to make a sizeable payment, even $10 extra dollars will help. Consider these strategies to help you get started.

Refinancing to a longer term may lower your monthly payments, but may also increase the total interest paid. Recasting your mortgage requires making a. If your credit score has improved or interest rates have plunged since you bought the car, refinancing can reduce your payments, and your credit.

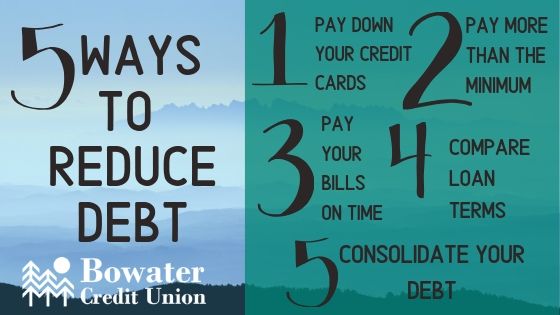

Ensure that you pay more than the required minimum amount. A debt management plan which is an agreement with your creditors managed by a financial company. The government raises money to pay the debt by selling.

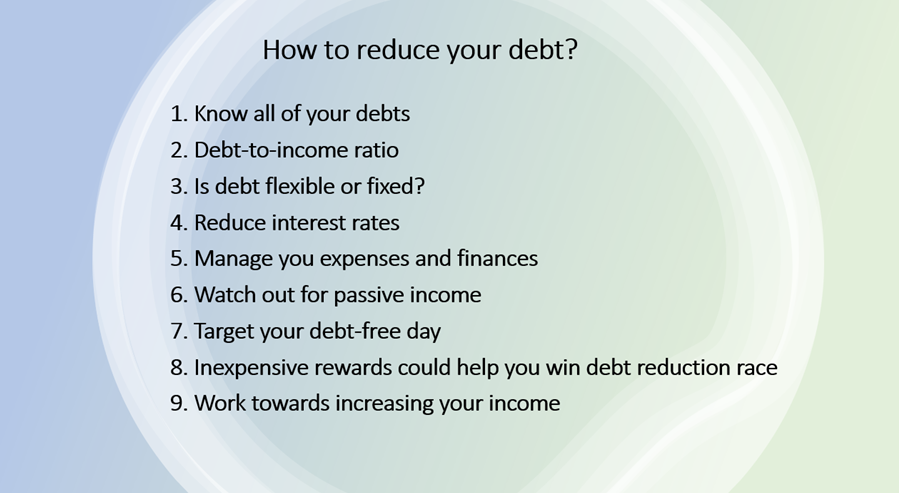

5 ways to reduce your monthly debt payments. Tips to help you reduce debt and pay it off for good get a clear view of your finances. If you're not bringing in enough money to cover your.

_1.jpg?ext=.jpg)