Glory Info About How To Buy Preference Shares

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

You do not need to have any broker to.

How to buy preference shares. Some preferred shares specify the date at which. You do not need to have any broker to. How to buy preference shares.

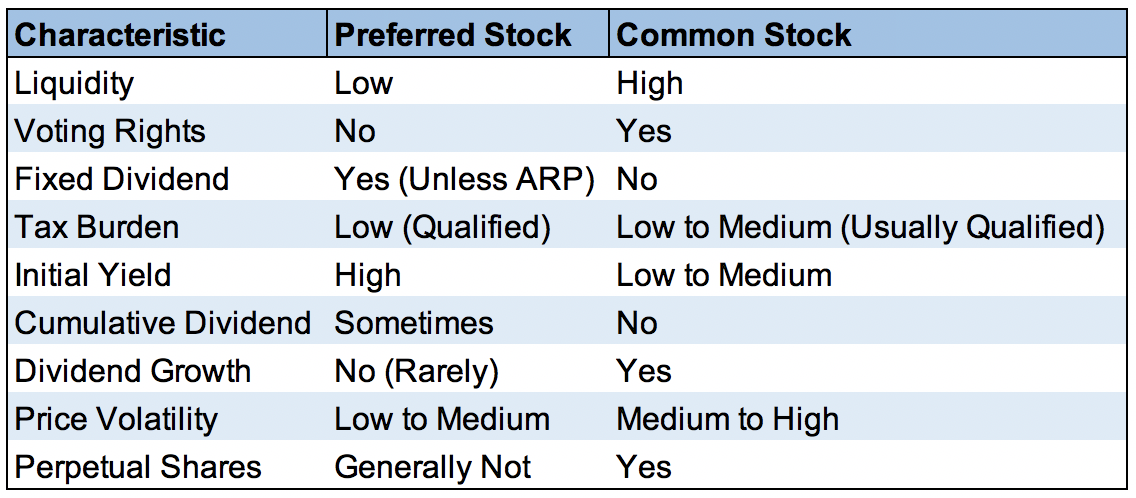

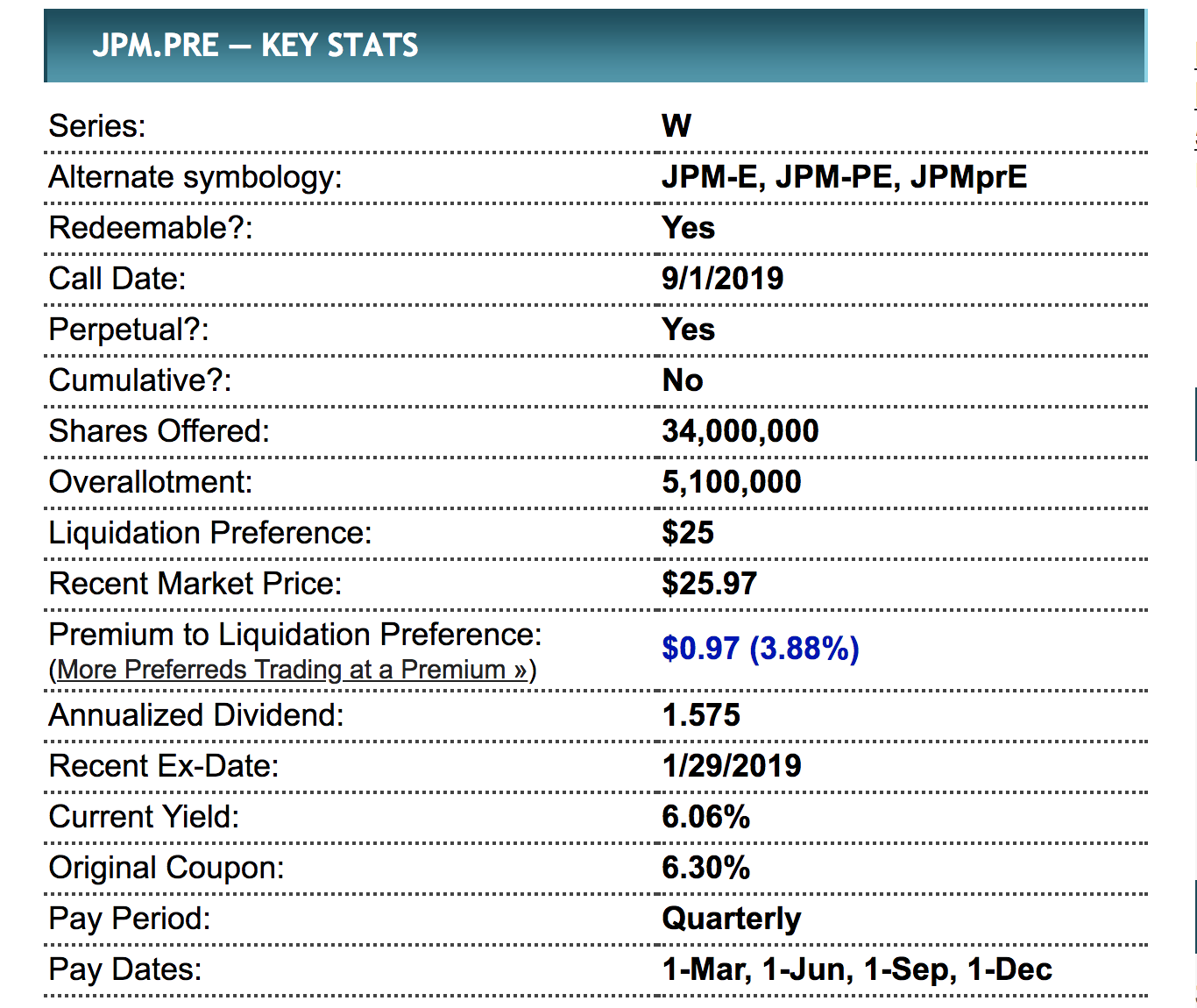

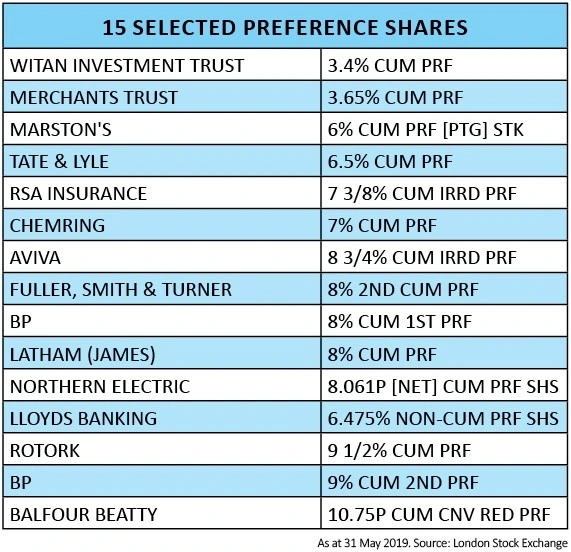

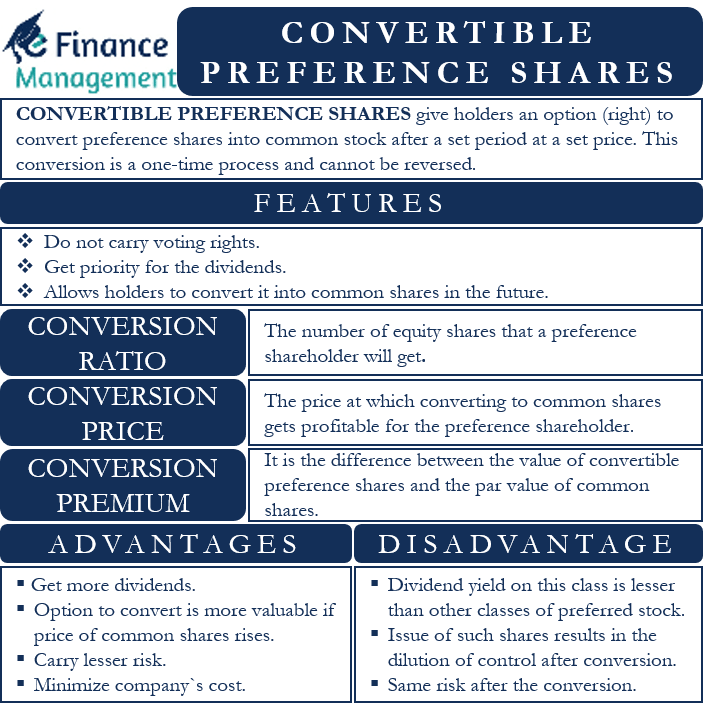

Retail investors can invest in preference shares through their favourite investing app or stockbroker account, provided that their broker includes these. Preference shares can be purchased by way of private placement, the minimum purchase. Preference shares vary and, depending on their structure, can be classified as ‘hybrid’ or ‘convertible’ securities.

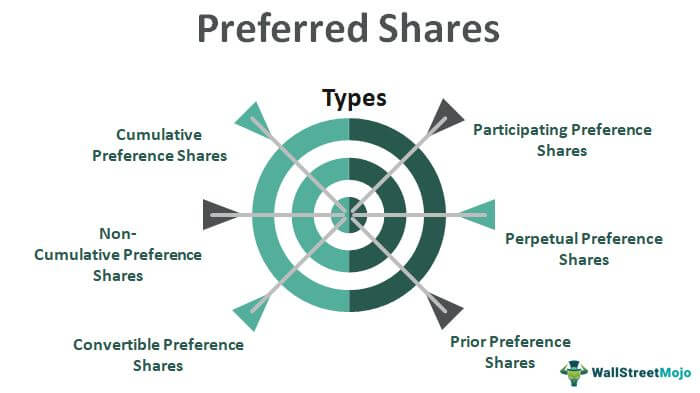

However, qatar has pledged to buy up 4.99% of the float, leaving 20.01% for the market. You can buy preferred shares of any publicly traded company in the same way you buy common shares: Types of preference shares based on redeemability 1.

Come to buy and sell digital shares of most popular internet websites and get dividend from your investments. How to invest in preference shares. The shares can be freely traded like any equity shares.

How to buy preference shares. In case of redeemable preference shares, the issuing company can purchase the. Through your broker, whether online through a discount broker or by contacting your.

If you buy them on the stock exchange, you will pay the. Come to buy and sell digital shares of most popular internet websites and get dividend from your investments. Tata capital had issued their preference shares at 8.33%, with seven year maturity, whereas l&t fin holding and il &.

/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)

/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)

/GettyImages-968680446-c87f6b0ea56748e2bdc73dfb4f96b688.jpg)